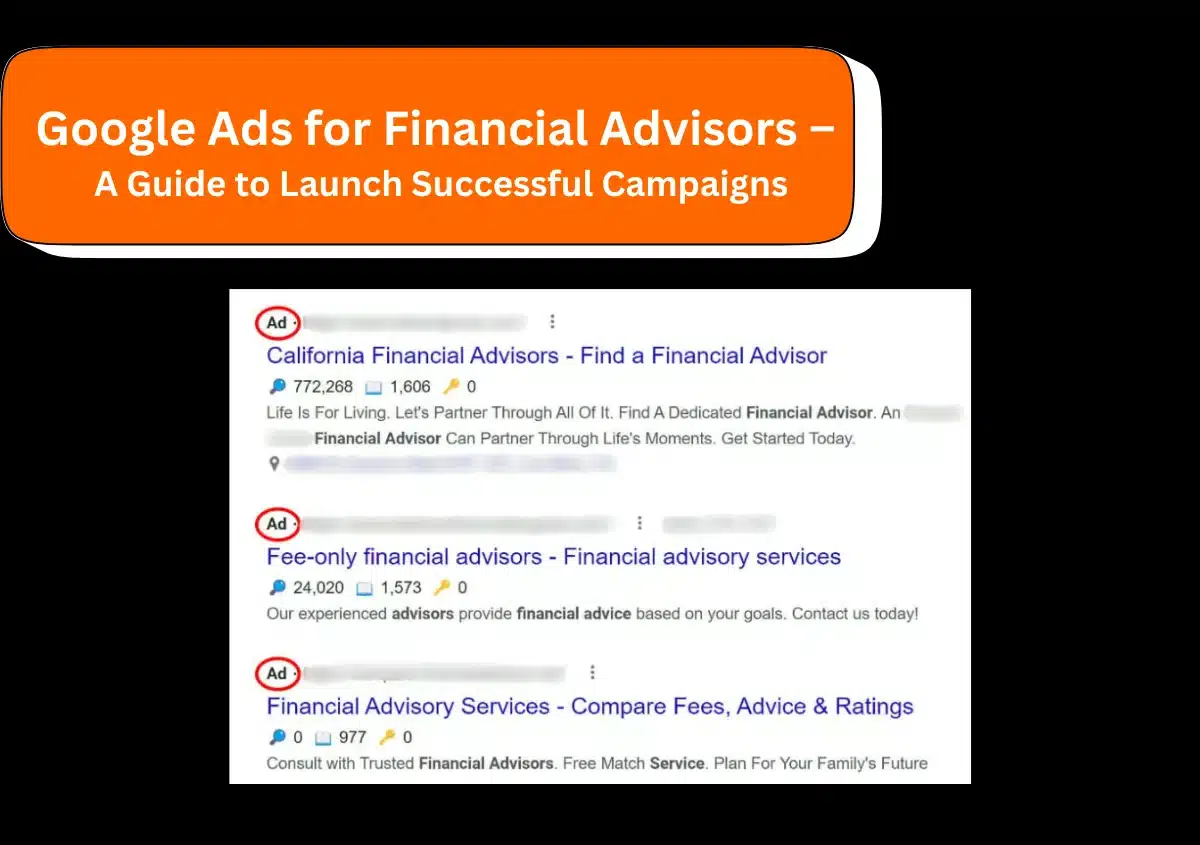

As the digital world expands, businesses in every domain use the tools and platforms at their disposal to gain an edge. The same is true for financial advisors. One such highly effective marketing platform is Google Ads.

Google Ads allows financial advisors to promote their services in various places on the search engines. The best part is that your ads show precisely to those who are seeking your financial advisory services.

You can easily target local or international clients based on your niche and grow your practice. In this post, we’ll take a deep dive into creating and running winning Google Ads for financial advisors.

How Do Google Ads for Financial Advisors Work?

Google Ads is an advertising medium that promotes your financial advisory or wealth management services on Google. Based on the type of ad you choose, it will be displayed on YouTube and many Google partner websites such as blogs and news channels.

Google Ads for financial advisors works on a bidding system. You bid on an amount for your ad, and Google determines where it will be shown in the search results, considering your bid and various other factors.

The ads can show above or below the organic search results in the Shopping tab or the Maps app.

You create a campaign and set the targeting of your keywords (where and whom will they be shown), place a bid, and get an Ad Rank by Google. After that, your ad is triggered when someone searches for a keyword related to your service.

With the help of a reputed PPC agency, you can build well-researched and highly targeted campaigns for your audience or niche and grow your business.

How Effective are Google Ads for Financial Advisors?

Google Ads are very effective for financial advisors when they are a part of a strong marketing strategy. If you use them as a part of your marketing plan, which includes SEO, email marketing, and social media marketing, then you will benefit from it. Your ads will show right at the top of search results for the keyword you target.

Using Google Ads is more beneficial than solely relying on organic leads through SEO. When PPC is a part of your overall digital marketing strategy, and you target the right keywords and optimize your ads, they get you the best results.

Moreover, you can customize your advertising campaign according to your budget and goals and use the various tools available to optimize their performance. The high level of precision targeting focuses your marketing efforts on people who are highly likely to engage with your services.

Best Types of Google Ads for Financial Advisors

Financial advisors can use many types of ads to promote their services and get leads. However, the most popular and effective ads are Google search ads, Google Local Services Ads, and display ads.

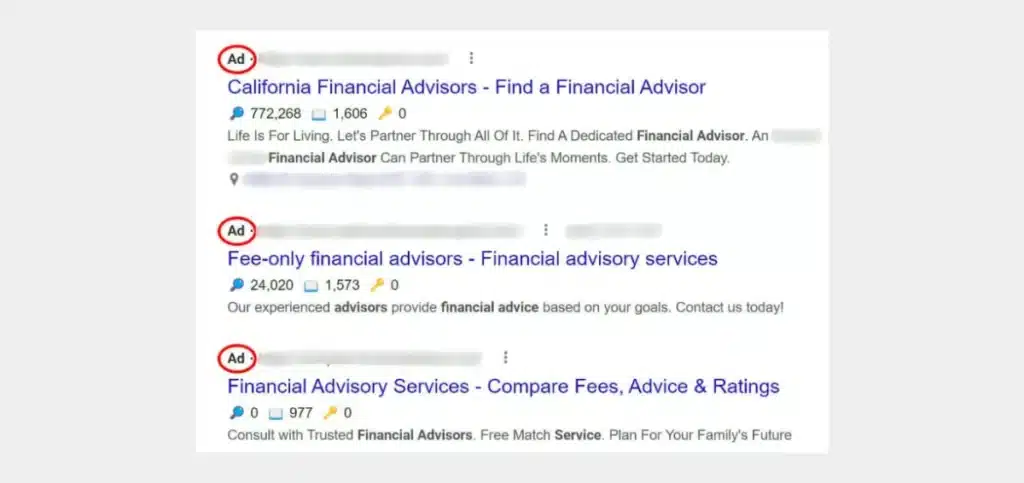

1. Google Search Ads

These are text-based ads that you see on search engine results pages whenever you type a keyword. For example, if someone searches for ‘financial advisor near me,’ your search network campaign ad will display at the top of all the organic search results. With this type of Google Ad, you can actively target people who are looking for financial advisory services.

2. Google Local Services Ads

Local service ads connect financial advisors to customers in their communities. This happens when your ads are displayed at the top of Google’s search results. Google shows local service ads according to a person’s location and search keywords. Some examples include ‘Financial Planners in Austin’ or ‘Wealth management firms in Pensacola.’

When these ads show, the user can contact you via phone or email or schedule an appointment directly. Local service ads work on a Pay-Per-Lead model, charging you only for the leads you receive.

3. Google Display Ads

If you are trying to spread awareness about your financial advisory firm and boost your overall brand presence, the display ad campaign will help you. This type of ad appears on a huge range of websites within Google’s Display Network, such as financial news sites and blogs. With this ad, you can target users who are not actively searching for a service but looking to gain information about particular finance-related topics.

How to Create Google Ads for Financial Advisors?

Now that you know the potential of Google Ads for your firm, let’s get to the details of creating a campaign.

1. Complete the Verification Process

Before creating Google Ads for financial advisors, it’s important to undergo a verification process. Google wants to know if you are a credible person providing financial advisory services. So, it asks you to complete verification wherein you need to provide the following:

- The financial services you offer

- Details of your license to give those services

- Your registration number

After sending this information, Google will notify you via email whether you have been verified or not. You can find all the information about getting verified for advertising financial advisory services here.

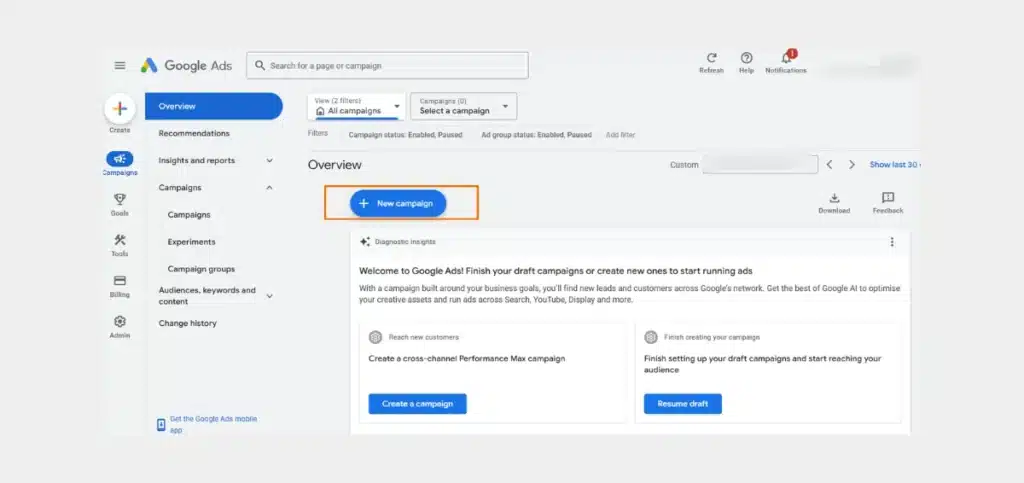

2. Create an Ad Account and Choose a Campaign Type

Sign up for Google Ads at ads.google.com with your business Gmail account. After that, set up your campaign. To do so:

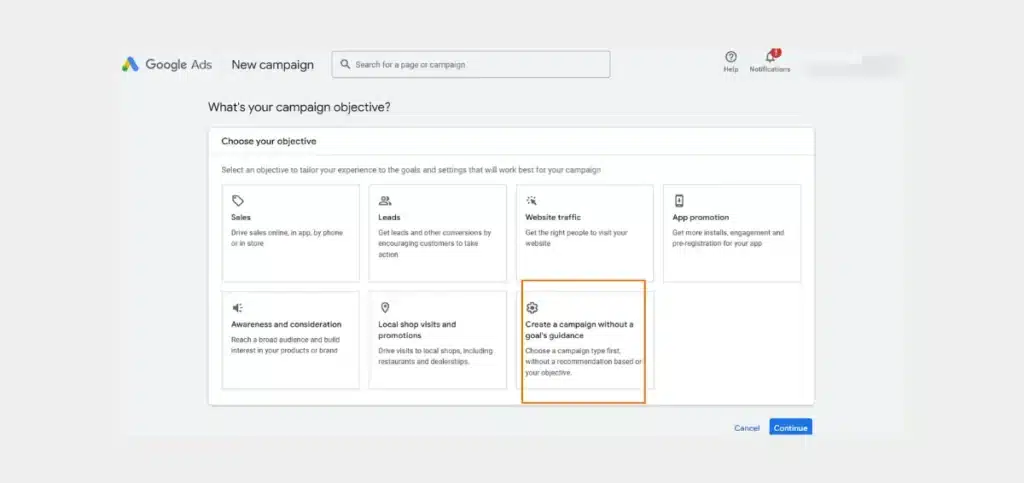

- Tap the ‘+New campaign‘ option on your ad account.

- You can choose any campaign objective from the options. If this is your first campaign, choose the ‘Create a campaign without a goal’s guidance‘ option.

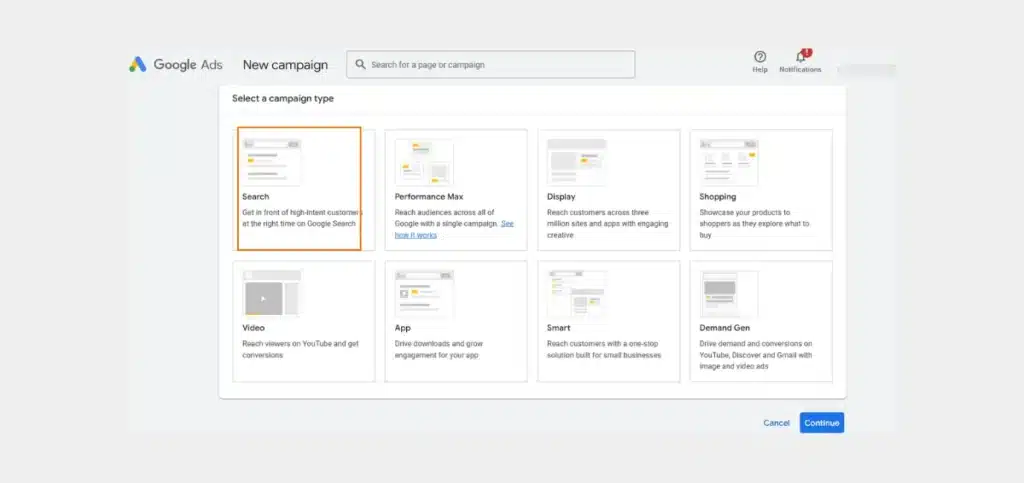

- Choose the ‘Search‘ campaign from the options. You can experiment with other options once you get experience running a few search campaigns.

3. Configure Settings of Your Ad

The next part is configuring general ad settings. On the Networks page, you’ll find the ‘Search Network’ and ‘Display Network’ options. Do not check both the options. This is because the search network settings make your ads appear on Google search partners. These are news sites, blogs, directory pages, and the like. Similarly, display network settings show the ads on YouTube, Gmail, Blogger, and many other areas where your potential customers won’t go.

After configuring the general settings, manage the dates and URL of your campaign. Set a starting and ending date for the financial advisory campaign.

You can add a tracking template, which is the URL you wish the ad click to go for tracking. This template is added to an ad group, campaign, or account level. It is applicable to all the ads in that group, campaign, or account.

4. Set up Precise Targeting of Your Ads

Set up Google Ads for financial advisors to appear to people in a certain area or location. Depending on where your target audience resides, this can be any city, such as Orlando, Austin, Delaware, or a group of cities.

Use the ‘Advanced search‘ option to indicate a precise location via map search or a radius.

If you are focusing on local clients, choose ‘Presence‘ over ‘Presence or Interest.’ It will make your ad appear to those who are physically located in your area.

Remember that today, there are many virtual financing tools and services. If you have a well-defined niche, such as financial advisory services for people in certain professions, do not focus a lot on targeting a particular geographic area. This is because your audience can be from any place.

After setting up targeting, choose English as your language preference.

5. Select Audience Segments Related to Your Potential Clients

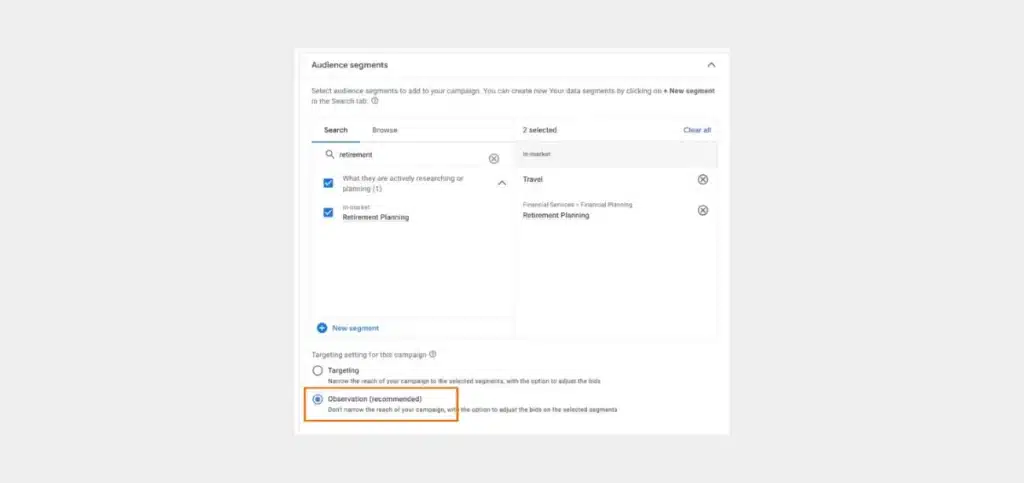

Audience Segments in Google Ads allow you to reach the precise type of audience you desire. Since you configured a Search campaign, use the ‘Observation‘ setting. It will prevent you from narrowing your campaign’s targeting. At the same time, you will be able to monitor how specific criteria perform with your financial advisory Google Ads.

6. Set a Budget and Choose a Bidding Technique

Start with a modest budget, but don’t cut it too short. It should be enough to help you get the data required to modify and optimize your ads. It should be at least 15 to 20 times more than the cost of your financial advisory keywords.

If your budget is lower than other advertisers’ budget, your ad will not show on the search results. You will be shown a recommended budget. Try to choose that to increase the visibility of your ads.

Here, it is wise to choose a manual CPC bidding technique, which lets you set your own maximum cost-per-click for your financial advisory ads. Suppose your maximum bid is $4 for every click, and the average cost per click for your target keyword is $3. It will show your ad on the search engine results. If this cost is over $4, your ad won’t get placed.

Note that the average cost per click is different for every region according to how competitive the keyword is. If you feel confused about setting the right bid, consult an experienced Google Ads specialist.

7. Use Assets (Extensions) to Increase Clicks

Google ads for financial advisors that have ad assets like phone numbers or page URLs get more clicks than those that don’t. Ad assets, formerly called extensions, allow you to add more information besides the headline, URL, and copy. Some major ad assets to include in your PPC campaign are:

- Sitelink extension: It’s a link to specific pages on your site.

- Callout extension: This extension lets you highlight features of your service, such as opening hours, no hidden fees, and more.

- Structured snippet: It adds a line of text in your ad showing all other services you offer. For this extension, you must select a header about the services you want to list.

- Call extension: It adds your business phone number to the ad

- Lead form extension: It adds a link to a form that you want to make a part of your ad.

- Location extension: Through this extension, you can add a clickable location at the bottom of your campaign.

- Price extension: It allows you to list your product’s prices and rates of services.

You can include all the extensions mentioned above, but it’s recommended to choose only those ones that match your goal and the purpose of the ad. To add an extension, go to ‘Ads & Extension’ on your campaign and tap ‘Extensions.’

8. Add Keywords in the Ad Groups

Ad groups in Google Ads group related keywords and ads with a single theme together. Thus, you can manage the campaign easily and facilitate a personalized user experience.

When your ads and keywords are in a specific ad group, you can tailor your messaging according to the particular needs of every target audience segment.

Before creating ad groups, it’s necessary to conduct thorough keyword research. Don’t only rely on the suggestions offered by Google. Use paid and free tools to carry out good keyword research for financial advisory ads.

You should find keywords related to your services, such as tax advisory, retirement planning, wealth management, or anything else. Make sure to find keywords with less competition but higher search volumes. Some good examples of such keywords include the following:

- Retirement management services

- Wealth management firms

- Financial advice near me

- IFA for pensions

- Certified financial planner

- Registered investment advisor

- Wealth advisor

- Personal finance advisor

After gathering a list of keywords, categorize them into groups based on the themes they represent.

Read Also:- How To Add Keywords To Google Ads?

9. Choose a Keyword Match Type

Every keyword you choose should be matched to a particular match type. If your keywords are not matched correctly, your ads will show to the wrong audience. In turn, this will waste your budget.

Broadly, Google Ad keywords should be categorized for the following match types:

- Broad match type: Broad match type keywords target many search terms and related keyphrases. Examples include ‘financial planning services’ and ‘wealth management solutions.’

- Phrase match type: Matching keyword to phrase match ensures that your ad appears for phrases in your keywords and some additional or related words. Examples include ‘financial advisor services’ and ‘retirement planning advisor.’

- Exact match type: This is a slightly restrictive match type that shows your ad to people who type the exact keyword you have used. Examples include ‘financial advisor near me’ and ‘best financial advisor services.’

11. Use Negative Keywords for Financial Advisor Ads

Building a negative keyword list is important for businesses in every domain. Otherwise, your ads appear for irrelevant searches, resulting in irrelevant clicks and a wasted budget. Negative keywords eliminate the chances of your ad appearing for searches that will not give you leads or conversions.

Some good examples of negative keywords for financial advisory firms include:

- Free advice

- Financial aid

- Pro bono financial advisor

- Financial training

- College financial aid

To find more negative keywords and boost the performance of your campaigns, seek the help of trusted Google Ads management services.

12. Create Your Financial Advisory Ad

After setting up keywords and ad groups, matching the keywords, and having a negative keyword list, create the ad. It means structuring the ad or ads for every ad group with headlines and descriptions. Use the following points to make your ad:

- Put the URL of the landing page that is associated with the ad in the ‘Final URL’ space.

- The display path shows how your landing page link will be displayed on the ad. Try to shorten the URL and avoid using articles.

- Create fifteen headlines of 30 characters each that are distinct from one another. They should highlight a compelling point about your service.

- Ideally, you should use four descriptions, but you need to include a minimum of two 90-character descriptions of your service.

Your descriptions should have essential keywords and a call to action. Write the most significant information about your service, which will make your target audience click your ad.

In the end, set up the payment plan for your ad.

13. Build Conversion-Oriented Landing Pages

The ad should direct visitors to targeted landing pages. If your landing page is poorly designed or not aligned with your ad messaging, it won’t lead to any gain. On the other hand, you will lose a potential customer or lead. When making landing pages for Google Ads for financial advisors, make sure of the following:

- It should be mobile-friendly

- It should have clear CTAs

- The landing page should answer the query of the visitor who has clicked your ad.

- Keep lead magnets or downloadable guides to attract the attention of the visitor and boost your credibility.

- Write attention-grabbing headlines that prompt people to explore the page

- Have social proof on the landing page

After you’re done making the landing page, review the ad campaigns by checking every setting. It’s essential before you start running the campaign.

14. Add the Conversion Tracking Tag to Your Landing Page

You want to ensure that your Google Ad campaign is successful. For this, you must be ready to track your lead generations and conversion efforts. An easy way to do this is by adding a conversion tracking tag to your website. The process to follow is given below.

- Tap ‘Tools‘ in your ad account, followed by the ‘Conversions‘ tab.

- Now, enter a conversion action name and select a type of action.

- Set up its value and count, and then choose when to track conversions.

- Next, add the Google Ads conversion tracking tag to your website.

- Go to the ‘Conversions‘ tab and tap ‘Google Ads Tracking‘ under the ‘Set up conversion tracking‘ option.

- Copy and paste this code to your website’s header.

- Save the changes made.

15. Monitor and Optimize Your Campaigns

Your Google Ads strategy is only effective when you continuously monitor your campaigns and make changes. When monitoring Google Ads for financial advisors, it is essential to focus on the following metrics:

- Click-through rate, or the percentage of people who click on your ad.

- Conversion rate, or the percentage of people taking the action you desire on your ad’s landing page

- Cost-per-click, or the money you pay for every click on your ad

- Cost-per-acquisition, or your spending to acquire a new client. This should be low with a high conversion rate, which means you are targeting the right people.

- Quality score, or the metric that assesses how relevant your ad, keywords, and landing pages are. A high score indicates greater visibility of the ads on search results and lower costs.

Read Also: How to Put a Password on Your Shopify Store?

Some Points to Remember When Creating Financial Advisory Firm Ads

When setting up financial advisors’ Google Ads, you must be aware of some rules. Ignoring the points below can lead to your ads getting banned.

- Your ads should not make false promises or claims about money. The ad content should be based on accurate facts about your services.

- Do not compare any features of your ads with those of another service. If there’s something about your firm that stands out, only then use it with proper evidence.

- Your ads should inform users about your firm’s services. They should not include instructions on what your potential customers should do with their money.

- If your ad’s landing page requires the personal information of the user, ensure that you disclose this fully in your website’s Privacy Policy.

- The testimonials should reflect the usual experience of your customers. Do not just keep the best experiences in your ads and landing pages.

- Do not use manipulative language in your ads about your products and services. Instead, rely more on the uniqueness of your services based on evidence to generate leads.

Conclusion

Successful Google Ads for financial advisors begin with a deep understanding of their ideal client base. Only after this should you set the goals, find keywords, and configure ad settings. When done right, Google Ads is a cost-effective and accountable way of staying ahead in the competitive financial advisory domain. If you want help with setting up highly targeted Google Ads that drive revenue, be sure to connect with Google ads agency, Website Pandas.