New York has a strong economy and is home to numerous small businesses. For those thinking of starting a business, an LLC is a good option. Limited Liability Company (LLC) is a popular legal business entity in New York. However, to form it successfully you need to carefully follow a series of steps.

In this post, we’ll give you detailed steps to form and start an LLC in New York.

Must Read: How to Promote Your Business Locally?

1. Name Your LLC

You’ll need to choose a name for your LLC that complies with the New York State law requirements for new LLC names. Brainstorm on a few names and create a list of potential ones. Then perform a name search to narrow the names down to those that are available for use.

Your LLC name should not have any prohibited phrases and include one of the following terms at the end:

- Limited Liability Company

- LLC

- L.L.C.

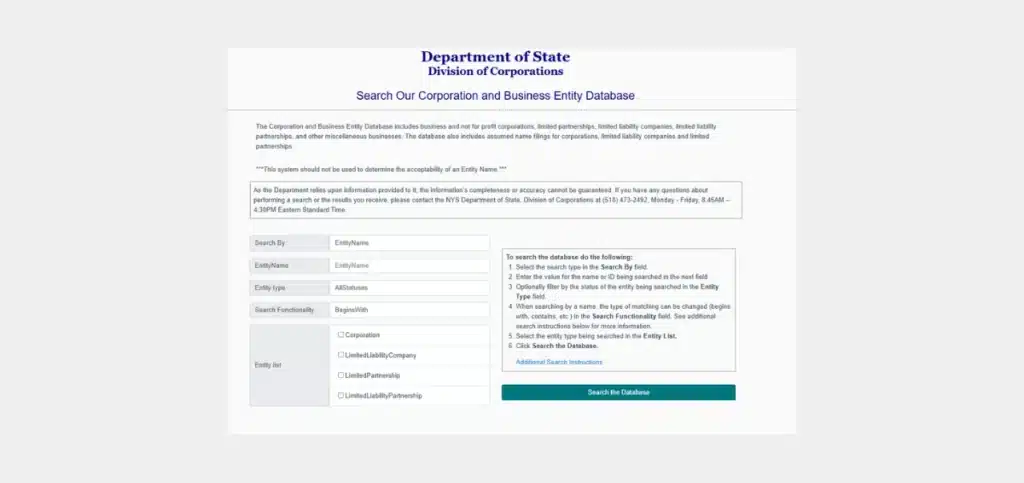

To ensure that your LLC name is different from all existing New York business names, check the New York State business name database.

2. Choose a Registered Agent

A registered agent is an entity authorized to receive legal documents for your LLC.

The agent can be a resident of New York or a company with a physical address in the city. The Secretary of State is your New York registered agent by default. They receive legal documents in connection with legal actions against your LLC.

You can also act as your own registered agent. Yet another option is to use a registered agent service. The registered agent accepts the service of process and manages legal documents on your behalf.

3. File Articles of Organization in New York

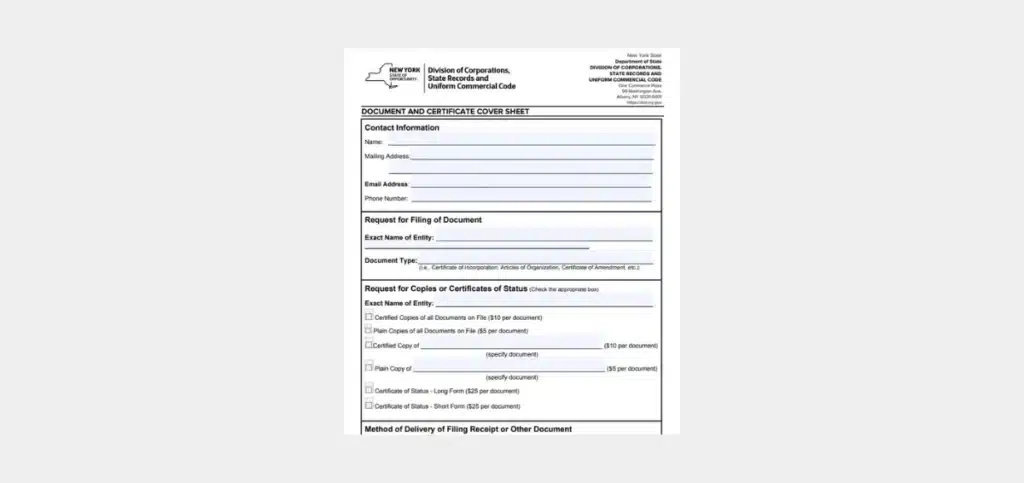

Draft, sign, and file your New York LLC articles of organization with the New York Department of State to officially form your LLC.

When you fill out the form, you must provide all essential details about your LLC. This includes the following:

- LLC name

- County of operation

- Registered agent details

- Filer’s name and mailing address

Organizational articles can be filed online or by mail for a $200 fee. If filing by mail, use the following address:

New York Department of State,

Division of Corporations,

One Commerce Plaza,

99 Washington Avenue,

Albany, NY 12231

4. Publish a Notice About Your LLC’s Formation

Under the New York State Limited Liability Company Law, your LLC must announce its establishment or formation in county newspapers.

The newspapers must be designated by the county clerk in which the registered agent or the office of the LLC is located. Here’s a list of some example newspapers where you can advertise.

After that, the newspaper publisher gives an affidavit of publication. This should be submitted to the New York Department of State with a Certificate of Publication and a $50 filing fee. Your LLC must comply with these requirements within 120 days of filing articles of organization.

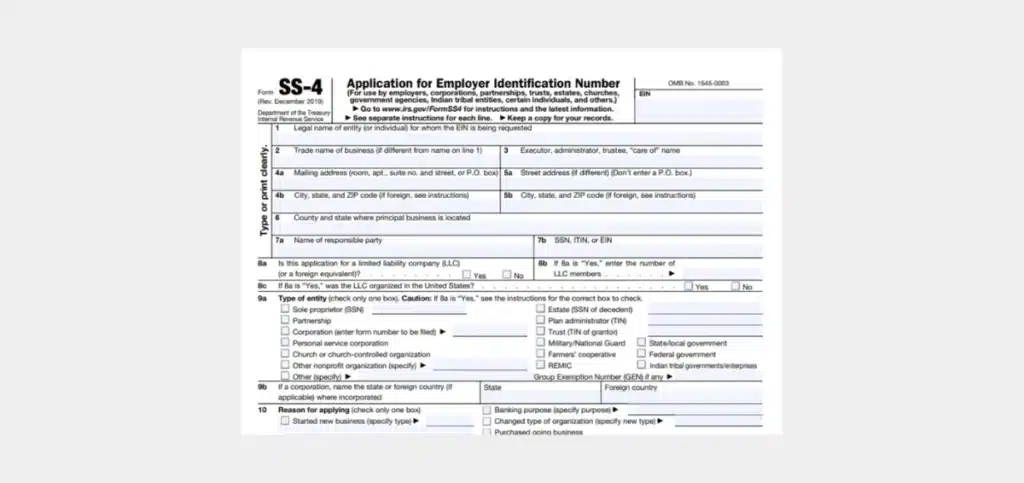

5. Get a Federal Employer Identification Number (EIN)

LLCs file taxes under a federal employer identification number (EIN). EIN is also an essential requirement for opening a business bank account, business credit card, and hiring staff. Obtaining an EIN is quick. Just fill out a form on the IRS website. There’s no fee involved.

Read Also: How to Register a Business in NY (New York)?

6. Create an LLC Operating Agreement

New York requires LLC members to adopt a written operating agreement Within 90 days of filing the articles of organization. The document is a legally binding agreement detailing the operation of your LLC will be run. Here are some of the things you need to explain:

- Basic company information, such as its legal name and address

- A description of each member’s rights, powers, responsibilities, liabilities, and obligations

- Documentation of initial investments

- Voting rules

- Plans for member compensation

- Processes for the departure or addition of members

- Conditions for amending the agreement

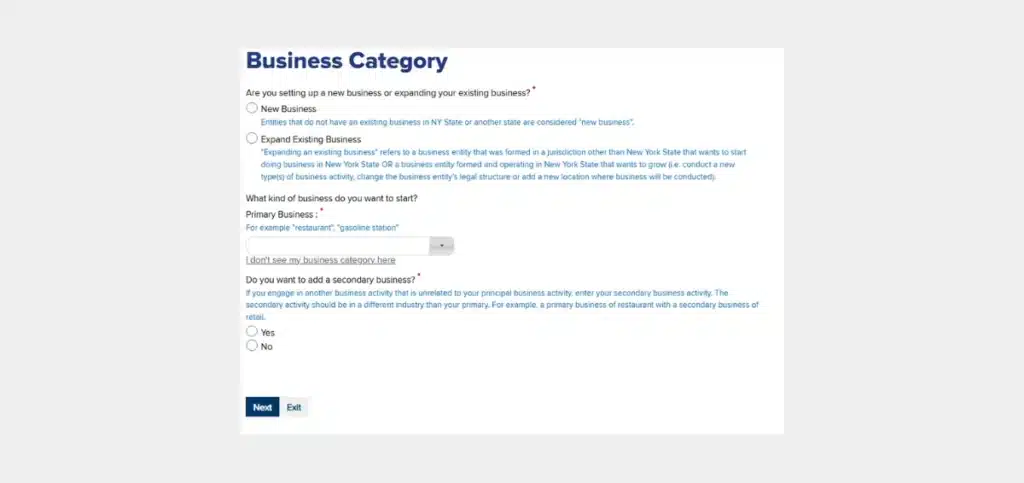

7. Obtain Licenses and Permits for Your LLC

Some cities in New York require a local license for specific types of businesses. You don’t need a general business license in the New York state. Go through New York State’s business regulations checklist to find the permits and licenses applicable to your LLC.

8. Understand the Tax Requirements

An LLC in New York follows a pass-through tax structure. This means any profits made pass through the LLC and onto its owners. Taxes are paid through your personal tax filings.

Depending on your business’s gross income, you may be required to an annual filing fee. Visit the New York State Department website to find the necessary tax forms for the year.

You may also need to pay sales tax. File a Certificate of Authority with the New York State Tax Department at least 20 days before conducting business to collect sales taxes for your state and city. If you don’t know whether your LLC is subject to sales tax, check out Tax Bulletin ST-175 (TB-ST-175) to know what goods and services are taxable.

9. Develop a Business Plan

A business plan is a written document detailing the purpose and plans of your business. Developing a business plan is not mandatory for an LLC in New York. But doing so helps you understand the broader scheme of your venture. Business plans also help you get funding or bring on new partners. It helps investors become more confident in working with you as they will see a return on their investment.

10. Purchase Insurance

Business insurance, such as general liability insurance or professional liability insurance protects you against lawsuits. Purchase the type of insurance depending on the operation of your LLC. Here are a few common types of insurance to look into.

- Liability insurance: Liability insurance protects your business against lawsuits resulting from bodily injury, and property damage, errors, omissions, and negligence.

- Workers’ compensation insurance: It provides benefits to employees who become injured or ill while working.

- Unemployment insurance: Unemployment insurance provides temporary income to employees who are laid off or let go through no fault of their own

- Disability insurance: In New York, LLC owners need to provide disability benefits to ill or injured employees who are ill or injured, even if the incident did not happen at the workplace.

- Health insurance: The federal law mandates LLCs to provide health insurance if they hire 50 or more employees.

- Property insurance: Property insurance can help protect your business from damage accruing from theft, vandalism, and natural disasters.

11. Look into Funding Options

You need capital to run your LLC. So, look into the options available for funding. Here are some you can consider.

- Personal savings: You can start your LLC with your own money.

- Funds from friends and family: If there are some people you trust and who are willing and able to invest in your business, use their support. However, ensure that you and them sign a written agreement detailing how they will be repaid.

- Crowdfunding: A crowdfunding platform is a system that lets people raise money for businesses by collecting funds from many people online. You can consider using such a platform to raise money.

- Private investors: As an LLC owner, you can look into using money from other investors to help with startup costs. Some examples include angel investors, venture capitalists, or any person investing their own money.

- Traditional small-business loans: Small-business loans offered by offered by banks and backed by the federal government, can be a great way to fund your LLC.

12. Market Your LLC

Marketing your LLC is crucial to reach out to your customers. Here are some ways to promote your business online.

a. Create and Verify Your Google Business Profile

Your Google Business Profile allows your business to appear in Google Maps results, and the local section of Google Search results, when someone enters your business name and location. To use your Google Business Profile, you must verify ownership of your listing through your free Google Business account. Then optimize your listing to appear higher in search result pages for more relevant searches.

b. Create a Website

Your website acts as a single destination for current and potential customers. No matter where they find you, they will want to go to your website to find out more about you. A good website improves the success of your other marketing tactics. For example, when you run ads, you need landing pages, which are present on your website. When you post on social media, it should link to its home on your site.

c. Implement Search Engine Optimization (SEO)

SEO is a set of practices that optimizes your website to appear when your target audiences enters search terms aligning with your offerings. SEO tactics to promote your LLC online include:

- Adding relevant (industry- and location-based) keywords to certain places on your website.

- Producing original, high-quality content regularly.

- Maintaining high page load speeds and security.

- Reaching out to an SEO agency will help enhance your search visibility. SEO experts create custom strategies based on your target market to drive traffic to your website.

d. Run Google Ads

For more immediate exposure, running a Google Ads (PPC) campaign is the best step. Google Ads ads show up at the top of search engine results pages, above organic and local listings. Mastering Google Ads takes some time. But an optimized campaign is worth the effort. Advertising on Google can be done via text ads on the Search Network or branded banner ads on the Display Network. You can also connect with a PPC agency in New York to drive targeted traffic and boost conversions through your ads campaigns.

e. Run Local Services Ads

Local Services Ads connect you to local customers looking for the services you offer online. They’re pay-per-lead rather than pay-per-click. It means that you only pay if someone contacts you through the ad. These ads appear at the top of the search results. These local ads help you find leads who are almost to become paying customers. They’re a highly cost-effective and efficient way to market your LLC locally. Partnering with a digital marketing agency will help you leverage the full potential of these ads for search engine visibility.

Summing Up

Many businesses operate as LLCs in New York. Members of this entity enjoy legal protection and flexible taxation. Use this post as a guide as you start the process of forming your own LLC. Reach out to us to promote your business online and gain more traction and sales.